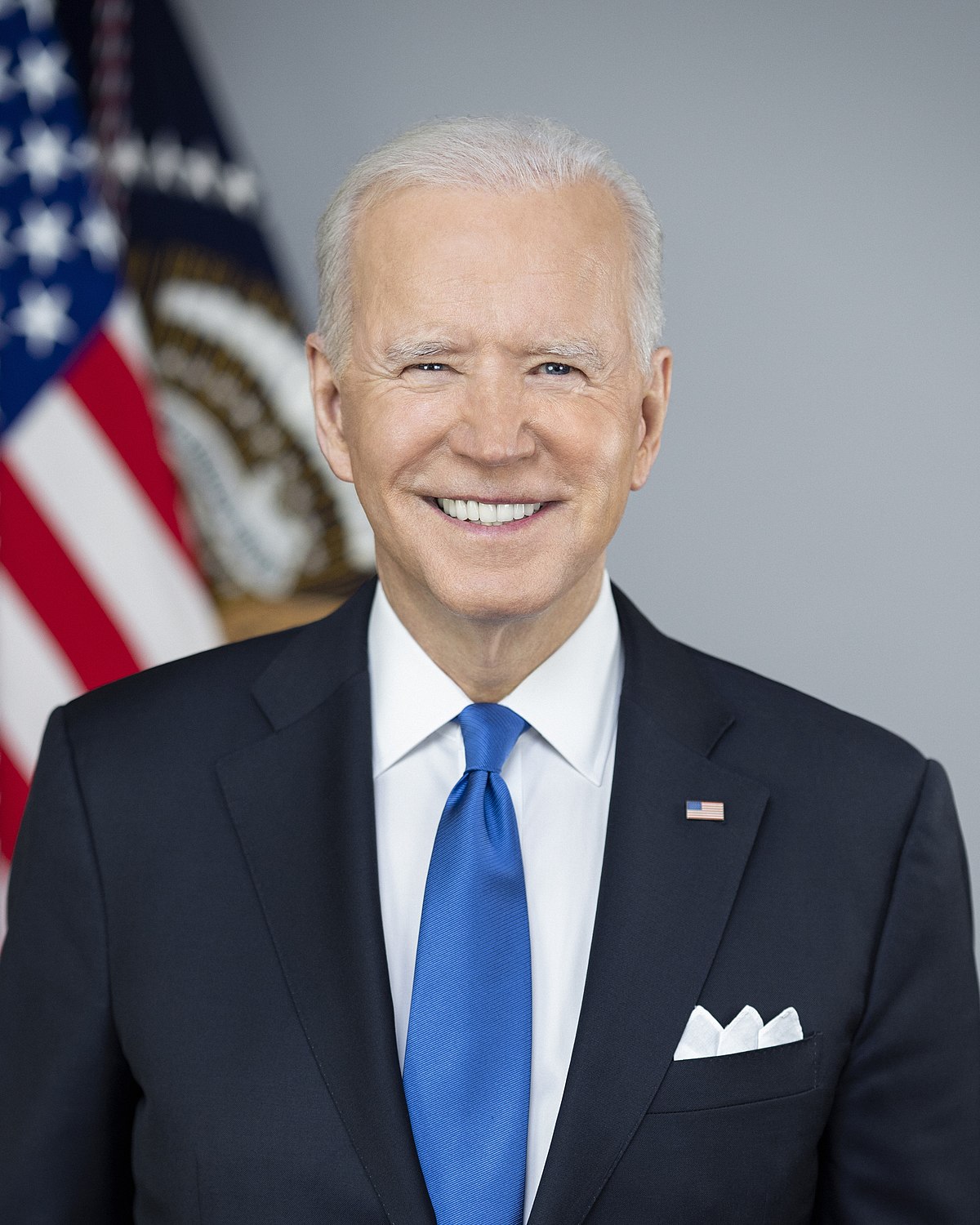

Biden’s tax plan shifting U.S. fossil fuel subsidies

U.S. Treasury Secretary Janet Yellen on Wednesday released an outline of a tax hike proposal that would lower subsidies for fossil fuel companies while increasing incentives for clean energy in President Joe Biden’s infrastructure plan.

A Treasury Department office estimated that eliminating subsidies for fossil fuel companies would boost government tax receipts by more than $35 billion in the coming decade.

The “Made In America” tax plan did not specify specific tax breaks for fossil fuel companies that would be targeted. It said the historical subsidies undermine long-term energy independence and align with factors creating climate change

One of the top fossil fuel breaks is called intangible drilling costs, which allows producers to deduct most costs from drilling new wells. The Joint Committee on Taxation, a nonpartisan congressional panel, has estimated that ditching it could generate $13 billion over 10 years.

The Biden tax plan would advance clean electricity production by providing a 10-year extension of the production tax credit and investment tax credit for clean energy generation, such as wind and solar power, and energy storage. It will also create a tax incentive for long-distance transmission lines used to create an eco-friendly smart grid across the United States.

The plan would restore a tax on polluters to pay for Environmental Protection Agency costs associated with Superfund toxic waste sites, addressing the harm caused by fossil fuel production.

Greenpeace, an environmental group, said the plan does not go far enough, citing a study here calculating that U.S. fossil fuel companies get $62 billion a year in implicit subsidies for not having to pay for the damage their products do to the climate and human health.

The plan would restore a tax on polluters to pay for Environmental Protection Agency costs associated with Superfund toxic waste sites, addressing the harm caused by fossil fuel production.

Greenpeace, an environmental group, said the plan does not go far enough, citing a study here calculating that U.S. fossil fuel companies get $62 billion a year in implicit subsidies for not having to pay for the damage their products do to the climate and human health.

yes

Hello

New Freelancer Live streaming per hour service

UseFreelancer.com NEW live streaming software to get one on one per hour live service Such as Online teacher, Babysitting, Cooking Lessons, Craft Lessons, Fitness Lessons, Lawyer consultation, Doctor online visits, Coding Lessons, Language Lessons, any Lessons, Online Music Lessons, using our NEW lives streaming per hour service software

for more details

https://www.usefreelancer.com

and start making money at home

Welcome to the new advanced UseFreelancer.com

Enjoy your time

New Freelancer service Live streaming per hour

UseFreelancer.com NEW live streaming software to get one on one per hour live service Such as Online teacher, Babysitting, Cooking Lessons, Craft Lessons, Fitness Lessons, Lawyer consultation, Doctor online visits, Coding Lessons, Language Lessons, any Lessons, Online Music Lessons, using our NEW lives streaming per hour service software

for more details

https://www.usefreelancer.com

and start making money at home

Welcome to the new advanced UseFreelancer.com

Enjoy now